40+ Mortgage affordability calculator income

Thank you so much. Other lenders may no.

Budget Binder Printable How To Organize Your Finances Budget Printables Budgeting Budget Binder

How does the affordability calculator work.

. A back end debt to income ratio greater than or equal to 40 is generally viewed as an indicator you are a high risk borrower. The loan is secured on the borrowers property through a process. 1 Law Assignment Help Service.

Once your mortgage balance falls beyond a certain amount such as around 50000 its likely not worth remortgaging with a new lender. In addition to housing costs your total monthly debt load would include credit card interest car payments and other loan expenses. Below are some of the common questions we receive around affordability and the required income calculator.

Most people need a mortgage to finance a home purchase. Urban High School Student. This paved the way for two new agencies.

The housing expense or front-end ratio is determined by the amount of your gross income used to pay your monthly mortgage payment. A 40-year mortgage with a variable rate Borrowers can get an adjustable-rate mortgage ARM with a 40-year term. Focus on Affordability and 1010 Quality.

A mortgage loan or simply mortgage ˈ m ɔːr ɡ ɪ dʒ in civil law jurisdicions known also as a hypothec loan is a loan used either by purchasers of real property to raise funds to buy real estate or by existing property owners to raise funds for any purpose while putting a lien on the property being mortgaged. Also offers loan performance graphs biweekly savings comparisons and easy to print amortization schedules. If your mortgage balance is already small.

Use our comprehensive online mortgage calculator which shows the monthly interest only and repayment amounts on a mortgage. Income and the calculator will display rentals up to 40 of your estimated gross income. Property managers typically use gross income to qualify applicants so the tool assumes your net income is taxed at 25.

The Federal Housing Administration FHA and the Federal Savings Loan Insurance Corporation. Lenders want to ensure you can pay your mortgage so theyll typically only approve you if your annual payments are less than 30 of your annual income. NRI should input net income.

Calculate Your Mortgage Qualification Based on Income. The calculator also allows the user to select from debt-to-income ratios between 10 to 50 in increments of 5. The minimum down payment is 5 for the first 500000 10 for the portion of the house price above 500000 up to 1 million dollars and 20 for any house price over 1 million dollars.

Select the term of the mortgage and the repayment type Term years 5 years 6 years 7 years 8 years 9 years 10 years 11 years 12 years 13 years 14 years 15 years 16 years 17 years 18 years 19 years 20 years 21 years 22 years 23 years 24 years 25 years 26 years 27 years 28 years 29 years 30 years 31 years 32 years 33 years 34 years 35 years 36. You can use the slider to change the percentage of your income you want spend on housing. To calculate how much rent you can afford we multiply your gross monthly income by 20 30 or 40 based on how much you want to spend.

This rent affordability calculator from Zillow uses your specific financial situation to help you decide. Comparison of Education Advancement Opportunities for Low-Income Rural vs. In an effort to strengthen the residential mortgage market Congress passed the National Housing Act of 1934.

While determining mortgage size with a calculator is an essential step it wont be as accurate as talking to a lender. Use our mortgage calculator to estimate your monthly house payment including principal and interest property taxes and insurance. Use this calculator to figure home loan affordability from the lenders point of view.

For example some experts say you should spend no more than 2x to 25x your gross annual income on a mortgage so if you earn 60000 per year the mortgage size should be at most 150000. This guide will help you determine how much of your income you should put toward your mortgage payments every month. Our calculator includes amoritization tables bi-weekly savings.

Centers for Medicare. Results of the mortgage affordability estimateprequalification are. Mortgage Required Income Calculator FAQs.

Check out the webs best free mortgage calculator to save money on your home loan today. Please note that it is assumed the down payment is not borrowed. This was exactly what I needed.

Affordability Calculator How much house can you afford. Todays national mortgage rate trends. Visit this section to know more.

Income 1 Income 2 Multiple Amount. Use Ratehubcas Mortgage Affordability Calculator to help figure out the maximum purchase price that you can qualify for. You wont make enough savings because of the high fees.

If you use the additional options we deduct the rent from your income and. Excluding housing costs Expected down payment. From learning how much home you can afford to choosing and managing a mortgage our calculator tools resources can help you make an informed decision.

By 1933 around 40 to 50 percent of all residential mortgages in the United States were in default. Provides graphed results along with monthly and yearly amortisation tables showing the capital and interest amounts paid each year. Get pre-approved with a lender today for exact numbers on what you can afford.

Estimate your monthly payments with PMI taxes homeowners insurance HOA fees current loan rates more. Most mortgage programs require homeowners to have a Debt-to-Income of 40 or less though you may be able to get a loan with up to a 50 DTI under certain circumstances. A 40-year mortgage extends the mortgage term by 10 years when compared with a traditional 30-year mortgage.

If coupled with down payments less than 20 05 of PMI insurance will automatically be added to monthly housing costs because they are assumed to be calculations for conventional loans. With HDFC Home Loan Affordability Calculator you can know how much home loan you can afford thus helping you fix a budget for your home purchase. 2009 financial crisis the Bank of England implemented mortgage affordability testing rules which aimed to stop banks from offering risky loans where the borrower.

Should not be more than 40 of your gross monthly income. Please specify how much you would like to consider as down payment. Most lenders do not want your monthly mortgage payment to exceed 28 percent of your.

By entering just a few data points into NerdWallets mortgage income calculator we can help you determine how much income youll need to qualify for your mortgage. In this calculator you can inclue investments annuities alimony government benefit payments in the other income sources. Youve taken the first step to financial freedom by using this calculator but dont forget to check.

For today Thursday September 15 2022 the current average rate for a 30-year fixed mortgage is 619 increasing 11 basis points compared to this time. An ARM has a fixed rate for a set time for example five seven or 10 years and then adjusts periodically for the remaining.

Yen Mortgage Loan Calculator How Much Can You Afford To Buy In Japan Blog

Financial Organizer Debt Payoff Coloring Pages Etsy Paying Off Credit Cards Credit Card Tracker Debt Payoff Printables

Debt Snowball Calculator Debt Snowball Calculator Interest Calculator Mortgage Payoff

Primary Residence Value As A Percentage Of Net Worth Guide

I Make 15 An Hour I Work A 40 Hour Week How Much Do I Take Out For Taxes Since I M Self Employed Quora

Payment Schedule Template Excel Beautiful 8 Printable Amortization Schedule Templates Excel Template Amortization Schedule Schedule Templates Schedule Template

Late Payment Letter Samples Templates Download Inside Late Payment Letter Template In 2022 Credit Repair Credit Repair Companies Credit Companies

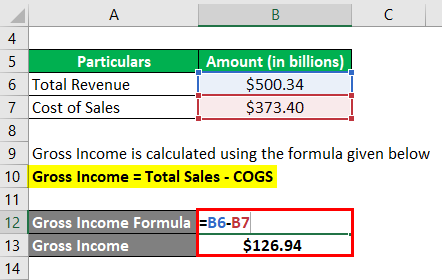

Gross Income Formula Calculator Examples With Excel Template

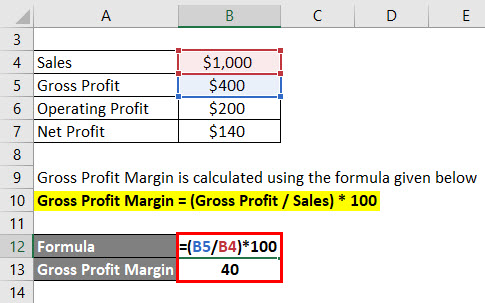

Debt To Income Ratio Formula Calculator Excel Template

How Much Should You Spend On That Life And My Finances

Yen Mortgage Loan Calculator How Much Can You Afford To Buy In Japan Blog

Budget Template Uk Seven Things You Most Likely Didn T Know About Budget Template Uk Budget Planner Template Monthly Budget Planner Budget Planner

40 Best Free Material Design Bootstrap Templates 2021 Bootstrap Template Material Design Portfolio Template Design

Income Statement Formula Calculate Income Statement Excel Template

Printable Sample Loan Template Form Contract Template Student Loans Loan Application

Payroll Calculator Template Free Payroll Template Payroll Templates

Tumblr Loan Application Application Form Personal Loans